Meeting the Highest Standards Under ERISA

Retirement plan sponsors face increasing scrutiny under the Employee Retirement Income Security Act (ERISA). The Department of Labor (DOL), evolving case law, and recent court decisions have raised the bar for fiduciary conduct and documentation. For many sponsors, the challenge isn’t simply meeting the baseline requirements — it’s maintaining the highest standards of fiduciary oversight in a rapidly changing compliance landscape.

In this post we break down what “meeting the highest standards” means in practice, where fiduciary liability commonly arises, and how an outsourced 402(a) fiduciary can reduce your exposure while keeping your employees’ interests front and center.

Watch the full podcast episode on YouTube

What Does ERISA Require of Plan Sponsors?

ERISA establishes strict standards for those who manage retirement plans. Key fiduciary duties include:

- Act solely in the interest of plan participants and beneficiaries.

- Carry out duties prudently and with appropriate documentation.

- Diversify plan investments and follow the terms of plan documents.

- Monitor service providers and plan fees, with annual benchmarking and documented processes.

- Provide participant education and maintain meeting minutes that show deliberation and decision-making.

Key takeaway: These actions are not optional. Failure to follow them can result in lawsuits, DOL action, and personal liability for named fiduciaries.

The Burden of Fiduciary Liability

Many plan sponsors underestimate the personal liability exposure they take on. Unlike service providers, plan sponsors often do not hold industry certifications or take tests that demonstrate ongoing ERISA expertise. That creates a gap between what ERISA expects and what most sponsors can reasonably execute without support.

Why Outsource to an Independent 402(a) Fiduciary?

ERISA anticipates that sponsors who aren’t experts will delegate. Delegation, when done prudently, reduces sponsor liability and aligns decision-making with professional expertise.

Outsourcing to an independent fiduciary provides:

- Fiduciary risk transfer: legal assumption of duties (where contractually appropriate).

- Ongoing monitoring: quarterly investment reviews, fee benchmarking, and provider oversight.

- Documentation: meeting minutes, IPS enforcement, and audit-ready records.

- Access to ERISA expertise: legal and regulatory monitoring, and relationships with TPAs and recordkeepers.

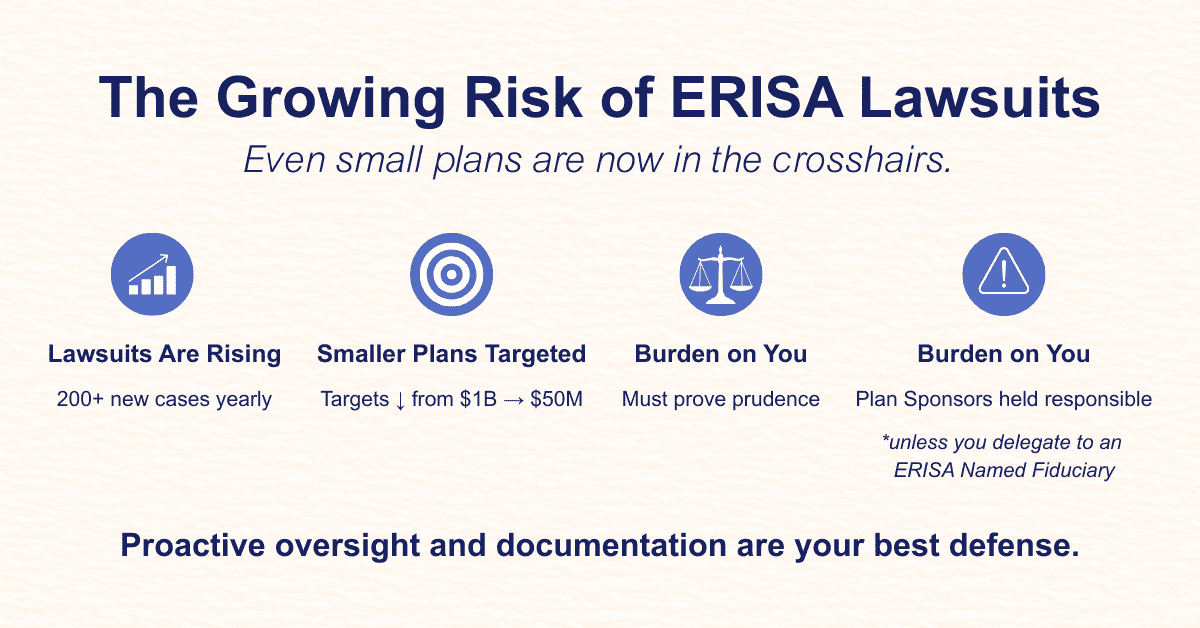

Recent Case Law and Rising Litigation Risk

Landmark rulings and recent decisions have materially increased litigation risk for plan sponsors. Courts are enabling participants to obtain information earlier and suing plans more efficiently. A notable example discussed in our episode is the Cunningham v. Cornell developments that shifted how courts evaluate plan sponsor responsibilities and increased the speed and ease with which plaintiffs can pursue claims.

The practical effect: target sizes for plaintiffs’ firms have broadened. Smaller and mid-sized plans are receiving attention they didn’t in prior years — which means sponsors at all levels need demonstrable, defensible processes.

How Fiduciary Wise Helps

At Fiduciary Wise we provide independent 402(a) fiduciary services designed to:

- Reduce the sponsor’s fiduciary risk through prudent delegation and contractual liability assumptions (where possible).

- Maintain audit-ready documentation — committee minutes, IPS adherence, benchmarking, and quarterly monitoring.

- Coordinate with TPAs, recordkeepers, and investment fiduciaries to ensure aligned governance.

- Monitor ERISA developments and adjust processes to reflect evolving legal standards.

Audit-ready documentation example

We capture committee minutes, benchmark reports, IPS reviews, and provider communications so a sponsor can demonstrate ongoing prudence if ever questioned.

What Should Plan Sponsors Do Next?

- Take inventory of tasks you (or your team) perform that require ERISA expertise.

- If you lack confidence, identify prudent experts and document delegation decisions.

- Ensure quarterly monitoring and annual benchmarking are in place and documented.

- Consider an outsourced 402(a) partner to shift liability and provide expert oversight.

If any of this is new or feels overwhelming, that’s perfectly normal. ERISA was designed for high standards — and it expects sponsors to engage experts if they aren’t specialists themselves.

Further resources & links

- Watch the full Wise Fiduciary podcast episode (YouTube)

- Learn more about our 402(a) fiduciary services (internal)

- Schedule a consultation with Fiduciary Wise (internal)

- U.S. Department of Labor — ERISA

Final thoughts

The “highest standards” under ERISA are high by design — and they evolve. Sponsors don’t have to become ERISA experts; they need prudent, documented processes and access to specialists. An outsourced 402(a) fiduciary can be the practical bridge between ERISA’s expectations and a sponsor’s capacity to deliver.

Ready to talk? Schedule a meeting or watch the episode to hear the team break this down in a skit and discussion.