Private Equity in Retirement Plans: A Fiduciary’s Perspective

By Don Jones, Fiduciary Wise

Introduction

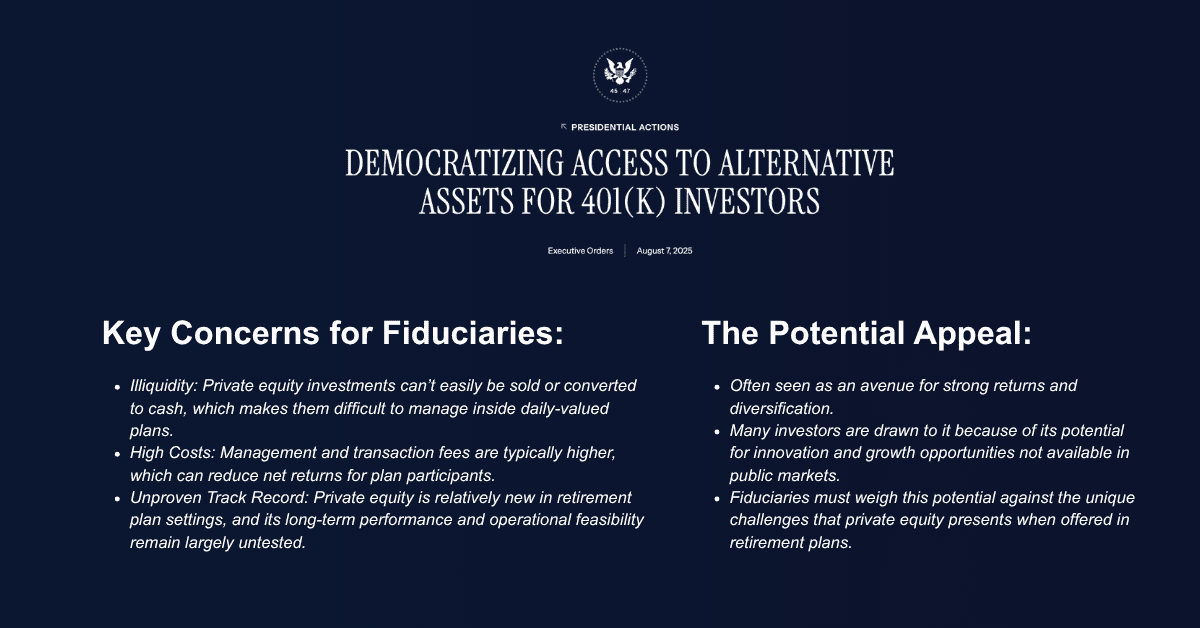

A new executive order, “Democratizing Access to Alternative Assets for 401(k) Investors,” has sparked renewed interest in the idea of allowing private equity in participant-directed retirement plans. For many plan sponsors, this raises an important question: should private equity play a role in 401(k) and 403(b) plans?

At Fiduciary Wise, our role as an ERISA 402(a) Named Fiduciary is to help plan sponsors navigate decisions like these with clarity, caution, and a strong focus on participant protection.

The Potential Appeal of Private Equity

Private equity can offer appealing opportunities for growth and diversification. It’s often seen as a way to access innovation and long-term value that might not exist in public markets.

However, when it comes to retirement plan fiduciary oversight, fiduciaries must look beyond potential returns. Private equity carries unique risks and structural challenges that make it very different from traditional mutual funds or collective investment trusts.

Key Concerns for Fiduciaries

Before a plan sponsor adds private equity to a retirement plan lineup, several key considerations should be evaluated carefully:

- Illiquidity: Private equity investments can’t easily be sold or converted to cash, which makes them difficult to manage inside daily-valued plans.

- High Costs: Management and transaction fees are typically higher, which can reduce net returns for plan participants.

- Unproven Track Record: Private equity is relatively new in retirement plan settings, and its long-term performance and operational feasibility remain largely untested.

These challenges don’t automatically make private equity a poor choice, but they do require a disciplined, procedurally prudent decision-making process.

Private equity may enhance diversification but introduces complexity and illiquidity.

Private equity may enhance diversification but introduces complexity and illiquidity.ERISA’s Conservative Framework

ERISA has long provided a conservative structure for fiduciaries, emphasizing prudence and long-term protection of participants’ interests. The Supreme Court reaffirmed this in Cunningham v. Cornell University, underscoring that fiduciaries must act with caution and careful judgment.

For fiduciaries, that means waiting until there’s sufficient regulatory guidance and market evidence before introducing new, complex investments into a plan.

Practical Guidance for Plan Sponsors

If you’re a plan sponsor evaluating private equity, consider the following best practices for fiduciary risk management:

- Wait for More Guidance: The Department of Labor is expected to release additional information on how private equity should be handled in retirement plans.

- Start Small: If private equity is introduced, consider doing so in a limited or pilot capacity.

- Prioritize Caution: Protecting participants from potential losses is often more important than pursuing higher returns.

- Document Decisions: Maintain detailed records showing the rationale behind investment choices to demonstrate fiduciary prudence.

These steps can help reduce retirement plan liability and strengthen your plan’s fiduciary protection.

Conclusion

Private equity may one day play a larger role in retirement plans, but for now, it remains illiquid, costly, and largely untested. Fiduciaries have a duty to act with care and loyalty, keeping participants’ best interests at the forefront.

Until additional guidance is available, the prudent approach is to observe, document, and proceed cautiously—if at all.

About Fiduciary Wise

At Fiduciary Wise, we serve as independent 402(a) Named Fiduciaries for retirement plans. Our mission is to help plan sponsors reduce fiduciary liability, stay compliant with ERISA, and protect plan participants through expert oversight and decision-making.

We specialize in:

- Retirement plan fiduciary outsourcing

- ERISA fiduciary liability management

- Independent fiduciary services for plan sponsors, TPAs, and advisors

- Outsourced fiduciary support for HR directors and plan committees

With decades of experience in fiduciary governance, we bring clarity, confidence, and compliance to every plan we manage.

Schedule a Meeting

If you’d like to learn more about fiduciary risk transfer or how outsourced named fiduciary services can support your plan, we invite you to connect with our team. Together, we’ll review your plan’s needs and create a strategy for stronger fiduciary oversight and long-term participant protection.