Welcome Karen Miller, QKA—Strengthening Fiduciary Wise’s Commitment to Excellence

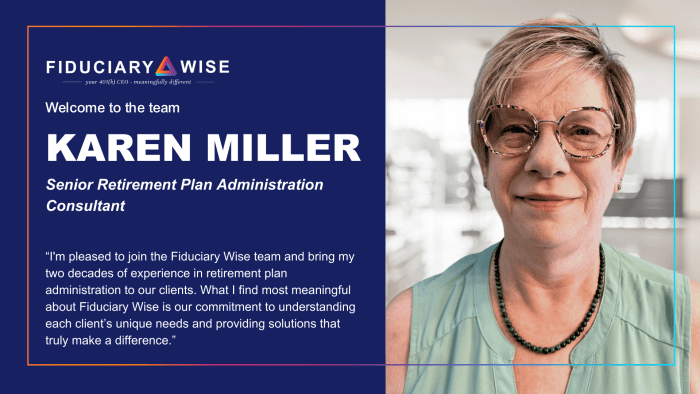

At Fiduciary Wise, our mission is to provide exceptional fiduciary services that empower TPAs, Record-Keepers, and Advisors to deliver top-tier retirement solutions while minimizing risk and maximizing efficiency. As the retirement landscape continues to evolve, we are committed to staying ahead of the curve by mastering the complexities of ERISA and ensuring that our clients’ plans meet the highest standards. Today, we are thrilled to announce the addition of Karen Miller, QKA, to our team as our new Retirement Plan Administration Consultant.

Why Fiduciary Wise?

The retirement plan industry is complex, with regulations constantly shifting due to new case law, Department of Labor updates, and evolving best practices. For TPAs, Record-Keepers, and Advisors, staying on top of these changes while managing day-to-day operations can be overwhelming. That’s where Fiduciary Wise comes in.

We partner with service providers to help them navigate the intricate world of ERISA with confidence. By working with us, you gain access to our deep expertise in ERISA and the Restatement of Law Thirds Trust, which ensures that your clients’ plans are consistently compliant with the latest standards. Our role as a named fiduciary under ERISA 402(a) allows plan sponsors to offload over 92% of the fiduciary risk, a responsibility that other service providers cannot assume. This protection not only safeguards plan sponsors from potential legal exposure but also provides peace of mind knowing that their retirement plans are in expert hands.

Saving Time and Reducing Costs

One of the greatest challenges for service providers is managing the cost and time associated with maintaining compliant and efficient retirement plans. Fiduciary Wise streamlines this process, helping to reduce plan expenses while saving valuable time for both service providers and plan sponsors. By handling the heavy lifting of fiduciary responsibility, we enable our partners to focus on what they do best—providing exceptional service to their clients.

Karen Miller’s addition to our team further strengthens our ability to deliver on these promises. With over 20 years of experience in retirement plan administration, Karen brings a wealth of knowledge and a meticulous approach to her work. Her dedication to efficiency, safety, and quality aligns perfectly with our mission to support service providers and plan sponsors in delivering superior retirement solutions.

Karen’s Commitment to Excellence

As Karen herself shares:

“I’m pleased to join the Fiduciary Wise team and bring my two decades of experience in retirement plan administration to our clients. With a focus on efficiency, safety, and quality, I’ve always strived to nurture strong client relationships and deliver optimal retirement solutions. What I find most meaningful about Fiduciary Wise is our commitment to understanding each client’s unique needs and providing solutions that truly make a difference. I’ve grown to appreciate the importance of a balanced, thoughtful approach—values that I see reflected in the way Fiduciary Wise operates. I’m looking forward to contributing to the continued success of our clients.” — Karen Miller

We are excited to have Karen on board and are confident that her expertise will enhance the value we provide to our partners. Whether you are a TPA, Record-Keeper, Advisor, or plan sponsor, Karen’s meticulous approach and deep understanding of retirement plan administration will ensure that your plans are not only compliant but optimized for success.

Take the Next Step

If you’re looking to reduce the burden of fiduciary responsibility, lower plan expenses, and save valuable time, Fiduciary Wise is here to help. We invite you to schedule a meeting with us or reach out to Karen directly at karen.miller@fiduciarywise.com. Together, we can create a more secure and efficient future for your retirement plans.